What Is Shared Appreciation? California Dream For All Explained

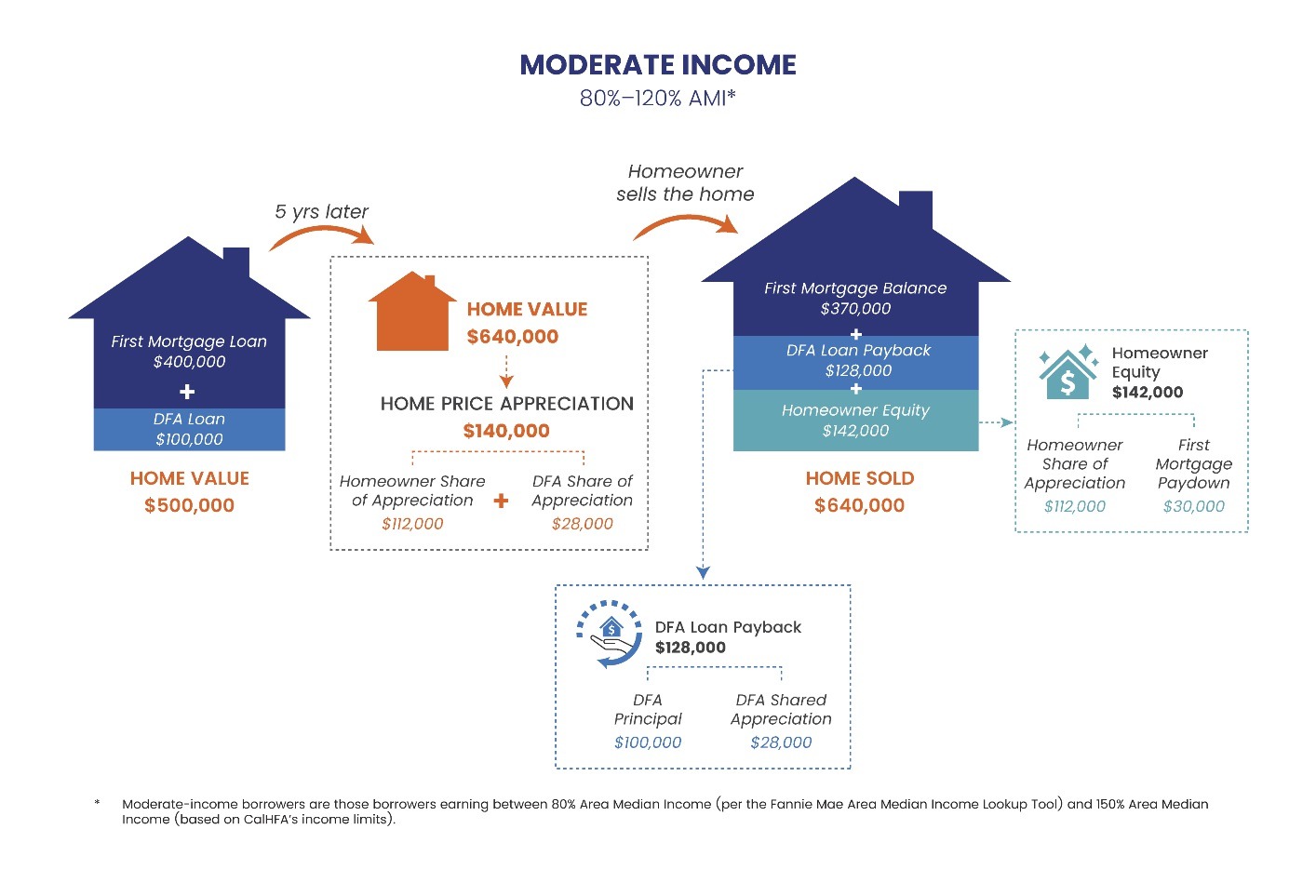

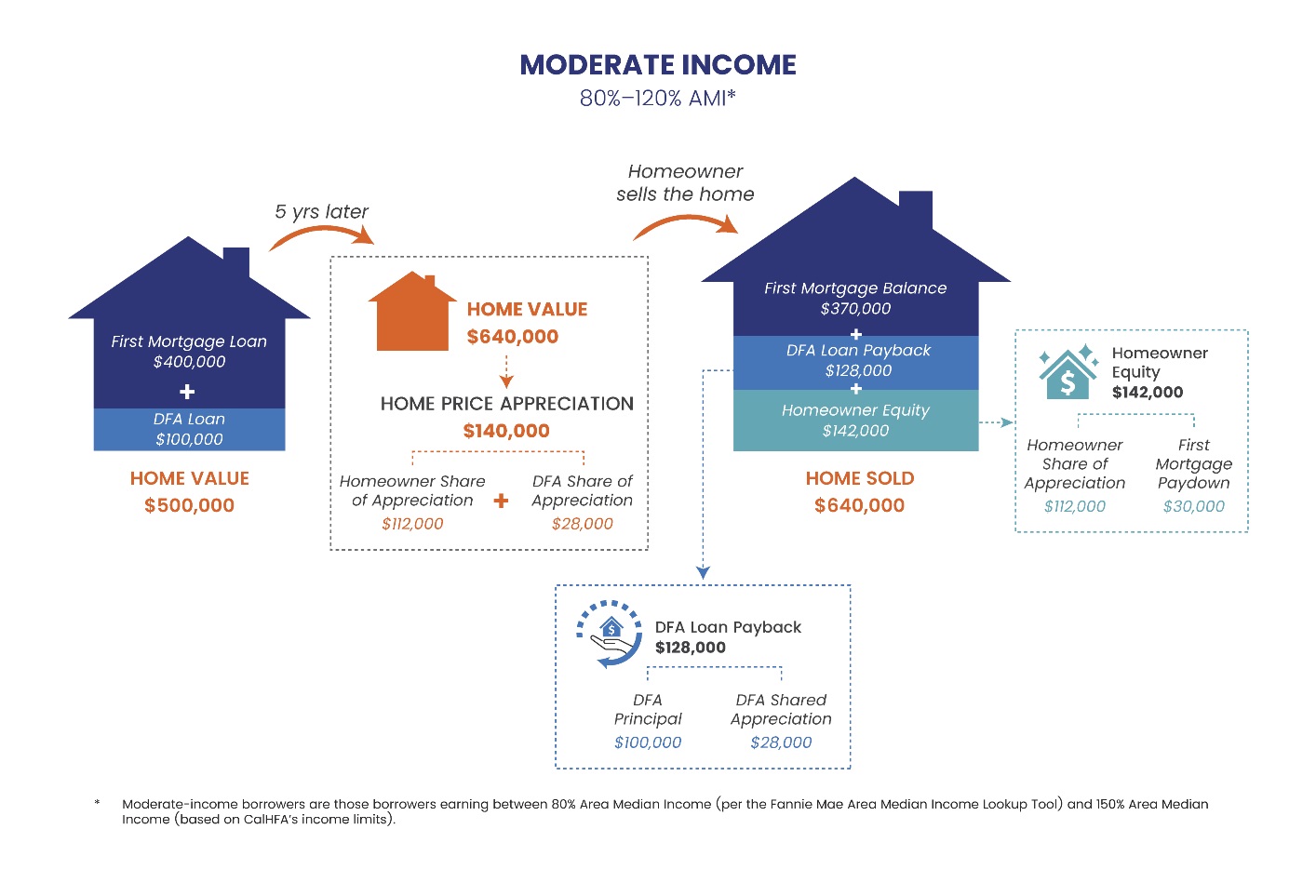

The California Dream For All program offers a unique opportunity for first-time homebuyers, but what exactly is shared appreciation, and how does it work? Shared appreciation is a simple concept with significant implications. How Shared Appreciation Works (Scenario): Imagine you're a first-time homebuyer purchasing a home valued at $500,000 with the help of the California Dream For All program. CalHFA provides you with a down payment assistance loan of $100,000, covering 20% of the home's purchase price and reducing your mortgage to $400,000. Now, let's fast forward a few years, and your home is now valued at $640,000. If you decide to sell or transfer ownership of your home, you'll need to repay the original down payment assistance loan of $100,000 to CalHFA. But here's where shared appreciation comes in: Shared Appreciation Agreement:In addition to repaying the initial loan, you'll also share a portion of the home's appreciation with CalHFA. Let's say the appreciation in the value of your home is $140,000 (640,000 - 500,000 = 140,000). With a shared appreciation agreement in place, you might repay a percentage of this appreciation, such as 20%*, to CalHFA. In this scenario, you would repay an additional $28,000 to CalHFA. DFA Loan Payback Breakdown:- Original DFA Loan: $100,000- DFA Shared Appreciation: $28,000- Total Paid: $128,000 What You Gain:Despite repaying the loan and shared appreciation, you still benefit from homeownership. Your original mortgage of $400,000 has been reduced over the years through mortgage payments to $370,000. This means you've effectively paid down your mortgage by $30,000, which is a form of forced savings that comes back to you when you sell your home. Here's the Complete Picture:- Sales Price: $640,000- Total Payback (Loan + Shared Appreciation): $128,000- Mortgage Balance Payoff: -$370,000- Homeowner Equity: $142,000 After the sale of your home, you walk away with $142,000. While not everyone will qualify for the California Dream For All program, and only a few will receive funding, it's essential to explore your options. Use tools like the down payment tool to see what other options you might qualify for and take steps towards achieving your homeownership dreams. For more detailed information about the California Dream For All program, including eligibility requirements, program highlights, and how to apply, visit the California Housing Finance Agency (CalHFA) website. There, you can explore comprehensive resources and access the latest updates on this transformative initiative aimed at helping first-generation homebuyers achieve their homeownership goals. Discover how shared appreciation and down payment assistance can make owning a home more attainable and learn about the steps you need to take to participate in this program. Don't miss out on this opportunity to embark on your journey towards homeownership with support from CalHFA. Visit their website today to learn more and take the first step towards realizing your California dream for all. *Borrowers whose income is less than or equal to 80%:Dream For All provides a loan for 20% of the home purchase price.The homeowner pays back the original loan amount plus 15% of any appreciation in the value of the home

The California Dream For All program offers a unique opportunity for first-time homebuyers, but what exactly is shared appreciation, and how does it work? Shared appreciation is a simple concept with significant implications.

How Shared Appreciation Works (Scenario):

Imagine you're a first-time homebuyer purchasing a home valued at $500,000 with the help of the California Dream For All program. CalHFA provides you with a down payment assistance loan of $100,000, covering 20% of the home's purchase price and reducing your mortgage to $400,000. Now, let's fast forward a few years, and your home is now valued at $640,000.

If you decide to sell or transfer ownership of your home, you'll need to repay the original down payment assistance loan of $100,000 to CalHFA. But here's where shared appreciation comes in:

Shared Appreciation Agreement:

The California Dream For All program offers a unique opportunity for first-time homebuyers, but what exactly is shared appreciation, and how does it work? Shared appreciation is a simple concept with significant implications.

How Shared Appreciation Works (Scenario):

Imagine you're a first-time homebuyer purchasing a home valued at $500,000 with the help of the California Dream For All program. CalHFA provides you with a down payment assistance loan of $100,000, covering 20% of the home's purchase price and reducing your mortgage to $400,000. Now, let's fast forward a few years, and your home is now valued at $640,000.

If you decide to sell or transfer ownership of your home, you'll need to repay the original down payment assistance loan of $100,000 to CalHFA. But here's where shared appreciation comes in:

Shared Appreciation Agreement:In addition to repaying the initial loan, you'll also share a portion of the home's appreciation with CalHFA. Let's say the appreciation in the value of your home is $140,000 (640,000 - 500,000 = 140,000). With a shared appreciation agreement in place, you might repay a percentage of this appreciation, such as 20%*, to CalHFA. In this scenario, you would repay an additional $28,000 to CalHFA. DFA Loan Payback Breakdown:

- Original DFA Loan: $100,000

- DFA Shared Appreciation: $28,000

- Total Paid: $128,000 What You Gain:

Despite repaying the loan and shared appreciation, you still benefit from homeownership. Your original mortgage of $400,000 has been reduced over the years through mortgage payments to $370,000. This means you've effectively paid down your mortgage by $30,000, which is a form of forced savings that comes back to you when you sell your home. Here's the Complete Picture:

- Sales Price: $640,000

- Total Payback (Loan + Shared Appreciation): $128,000

- Mortgage Balance Payoff: -$370,000

- Homeowner Equity: $142,000 After the sale of your home, you walk away with $142,000. While not everyone will qualify for the California Dream For All program, and only a few will receive funding, it's essential to explore your options. Use tools like the down payment tool to see what other options you might qualify for and take steps towards achieving your homeownership dreams. For more detailed information about the California Dream For All program, including eligibility requirements, program highlights, and how to apply, visit the California Housing Finance Agency (CalHFA) website. There, you can explore comprehensive resources and access the latest updates on this transformative initiative aimed at helping first-generation homebuyers achieve their homeownership goals. Discover how shared appreciation and down payment assistance can make owning a home more attainable and learn about the steps you need to take to participate in this program. Don't miss out on this opportunity to embark on your journey towards homeownership with support from CalHFA. Visit their website today to learn more and take the first step towards realizing your California dream for all. *Borrowers whose income is less than or equal to 80%:

Dream For All provides a loan for 20% of the home purchase price.

The homeowner pays back the original loan amount plus 15% of any appreciation in the value of the home

vigna

vigna